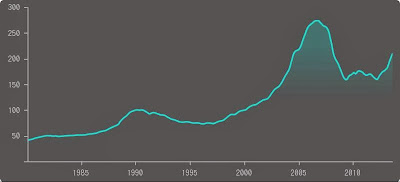

WASHINGTON — The biggest story in American real estate in 2013 hasn't gotten the attention it deserves, so let's shout this out: Homeowners' net equity holdings soared $2.2 trillion from the third quarter of 2012 to the third quarter of this year, according to new data collected by the Federal Reserve.

This is a record rebound for a 12-month period. And it's crucially important in personal financial terms for hundreds of thousands of owners who for years have been underwater on their mortgages, meaning their homes wouldn't sell for enough to pay off the loan.

They now have options they didn't have before: They can sell their homes and not have to bring money to the closing. They may be able to borrow against their equity to help pay for college tuition, home improvements and other purposes. They may be able to refinance their mortgages without having to use a government-aided program.

Home equity is the difference between the mortgage debt outstanding on a residence and the current market value of the home. If your house is worth $300,000 and you owe the bank $150,000 — whether from a single mortgage or multiple loans — you have $150,000 in equity. If your mortgage debt totals $350,000 on a $300,000 house, you have $50,000 in negative equity.

Equity generally grows in several ways: You lower your debt by making payments to your lender, the value of your house increases because market conditions improve, or you raise the home's sales value by remodeling or upgrading it.

Growing home equity not only signifies widespread recovery in household personal wealth, but also provides an important boost for the ongoing economic recovery. Consumers who have a cushion of equity in their homes are more likely to spend money on goods and services than those who don't. The latest Fed "flow of funds" calculations show that owners have now seen their equity stakes grow more than $3.2 trillion from the post-bust low point in the first quarter of 2011.

During the financial crisis of 2008-11, millions of American owners fell into negative equity positions as the sale value of their homes plummeted. With the recovery that took hold in 2012, values began to turn upward again — dramatically so in some of the hardest-hit areas where prices had fallen fastest.

A new study released by CoreLogic, an Irvine real estate and mortgage data firm, estimated that 791,000 homes moved from negative to positive equity status during the third quarter of this year alone, and more than 3 million have done so since the beginning of 2013. Though 6.4 million homeowners continue to be underwater on their mortgage debt — in 13% of all homes with a mortgage — that is down from 7.2 million (nearly 15%) as recently as the end of the second quarter of this year.

CoreLogic researchers found that among the states that experienced the most severe property devaluations during the bust and have recovered impressively, some continue to have persistent hangovers of negative equity. In Nevada, nearly a third of all homeowners are underwater, despite price gains. In Florida, nearly 29% are still in negative equity, and in Arizona it's nearly 23%.

In California, which suffered deep equity losses in non-coastal areas from 2007 to 2010, home values have roared back in the last two years. Now the state has just a 13% negative equity rate — significantly lower than Ohio (18%), Michigan and Illinois (both 17.7%), Rhode Island (16.6%) and Maryland (15.6%).

The states with the highest rates of homeowner equity are Texas and Alaska, where 96.1% of all owners with mortgages are in positive territory; Montana (95.8%); North Dakota (95.7%); and Wyoming (95.4%).

Other findings from the CoreLogic study:

•People with higher-priced homes are somewhat more likely to have positive equity than owners of lower-cost houses. Whereas 92% of all mortgaged homes in the country valued at more than $200,000 have positive equity, just 82% of homes valued at or below $200,000 do.

•Though homeowner equity wealth has increased rapidly in the last year, 10 million homeowners still have only modest equity stakes — less than 20% — and that puts them at risk should property values tumble again.

But another bust is nowhere in sight, thanks to tougher underwriting and regulatory oversight. So whether you're one of the recent arrivals to positive equity status, or you've enjoyed it all along, the new year looks encouraging.

Distributed by Washington Post Writers Group.